From pv magazine Global

Renewable energy corporate PPAs in the Asia-Pacific region are set to reach a record 7 GW of capacity in 2022, according to a new report by energy research company Wood Mackenzie. That corresponds to an 80% increase on 2021. In the second half of 2022, corporate renewables procurement is on pace to increase by about 4 GW.

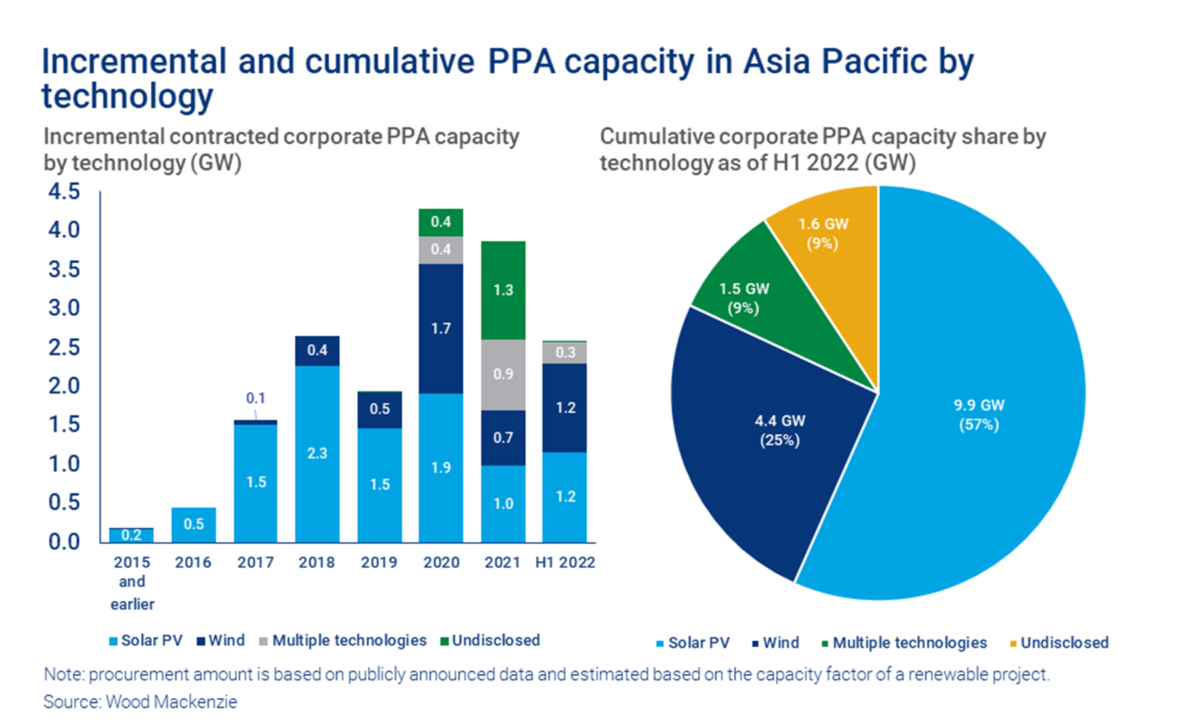

Solar dominates renewable corporate PPAs in the region, accounting for 57% of contracts.

“However, wind has been catching up since 2020 and accounted for 44% of new contracts in the region in the first half of 2022,” the report says.

In Australia, solar and wind account for 45% and 43% of PPA contracts, respectively. Solar dominates in India, with 82% of contracts. Wind – particularly offshore wind – accounts for 89% of total capacity in Taiwan.

“For the remaining countries in southeast and east Asia, solar accounts for nearly all contracted capacity,” said Wood Mackenzie.

As of the first half of 2022, India, Australia, and Taiwan were the top three markets in the Asia-Pacific region’s cumulative corporate PPA procurement capacity, accounting for 89% of the total, or 18.6 GW. India leads the charge, with 8.1 GW. Australia has 5.2 GW, while Taiwan has 3.2 GW.

Other countries account for the remaining 2 GW of contracted capacity, with Singapore, China, and Thailand completing the top six. South Korea, Cambodia, and Pakistan contracted the least capacity in the first half of 2022.

“In most Southeast Asian countries, including Cambodia, Thailand, Vietnam, Pakistan and the Philippines, PPAs are rooftop solar projects,” the report explains. “These are of limited size, reducing their contribution to capacity.”

The top developers in Asia’s corporate PPA market are Amp Energy, Amplus Solar, and Cleantech Solar. They have the vast majority of their capacity in India, according to the report. Most developers in the region are domestic and regional players. The key clients for PPAs are large energy users in the industrial, retail, and technology sectors.

“In Australia, companies including BHP and Newcrest use PPAs to power their mining operations,” says the report. “Other big users include supermarket chains and telecoms providers who use renewables to power their data centres.”

The Asia-Pacific region’s renewable corporate PPA capacity accounts for 15% of the global PPA market. The main barrier for further growth in corporate PPAs in the region is lack of regulation permitting large-scale procurement of renewables, according to Wood Mackenzie.

“Countries including South Korea, Japan, and China are all gradually easing regulations surrounding offsite corporate PPAs, which should open up opportunities in the coming years,” it says. “However, we expect Australia, India, and Taiwan to continue to lead future growth.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.