From pv magazine USA

California-based Luminia, a financier of community solar and other sustainability projects, reports that it closed 2022 with more than $2.5 billion in commercial solar financing requests across the United States, representing close to 200 MW of commercial solar projects, with a development pipeline of 600 MW of additional projects.

In 2022, Luminia (formerly SD Renewables), offered financing solutions that catered to commercial property owners across 36 states with diverse needs. Its solutions range from multi-family and industrial real estate investment trust (REIT) portfolios to private education institutions and agricultural projects.

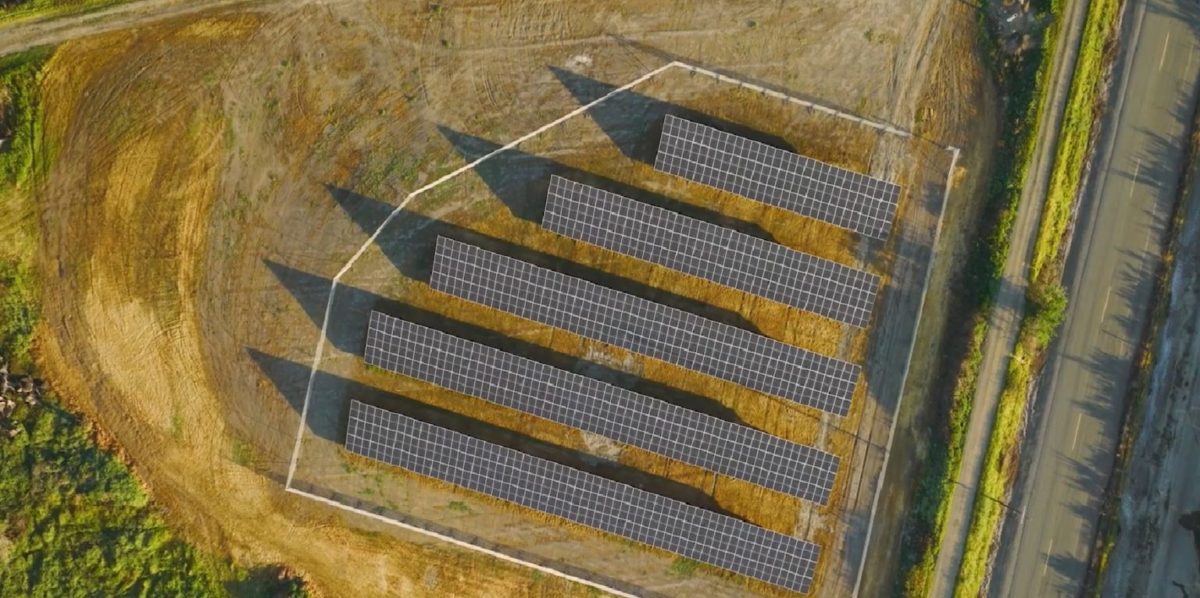

The company enables property owners to gain access to a range of sustainability and asset value improvements, such as electric vehicle charging infrastructure and water conservation improvements. The projects it supports vary in size and scope to meet individual state and municipal requirements with an average project size of 9.5 MW. The five key markets for the company are Massachusetts, New York, Maine, New Hampshire and New Jersey. In Maine, Luminia closed a 15 MW of community solar project with NH Solar Garden in 2022, providing access to intermediate and long-term financing.

Popular content

Luminia continues to expand its suite of financial offerings catered to large commercial portfolio owners.

“Our REIT-friendly financing structures allow landlords to efficiently share the benefits of solar with their tenants, enabling both landlords and tenants to profitably accelerate solar adoption and meet their ESG objectives,” said Jim Kelly, the co-founder of Luminia. “In addition, our strategic focus on community solar provides yet another option for our portfolio clients to monetize their rooftops.”

Luminia’s solution was recently launched on Energy Toolbase’s ETB Developer platform, which helps developers to access power purchase agreement quotes and additional financing options that are intended to match customer needs.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.